March 19, 2021

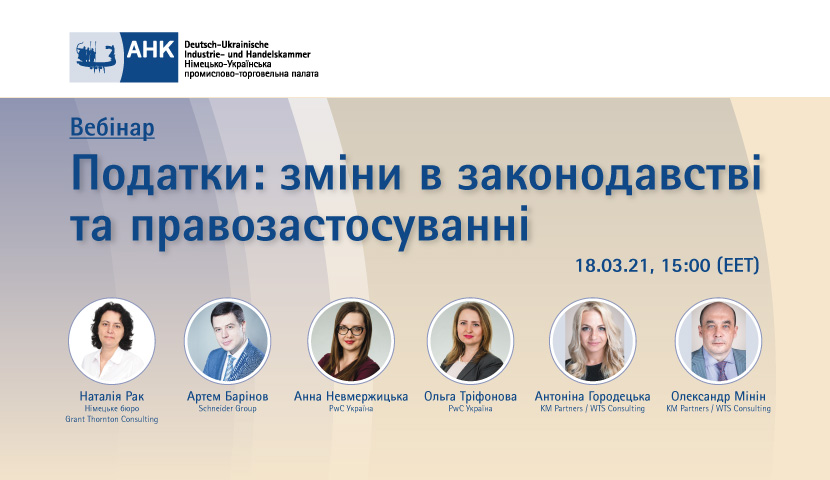

On March 18, 2021, a webinar on “Taxes: Changes in legislation and law enforcement” was held by the German-Ukrainian Chamber of Commerce and Industry. ![]() Senior Partner Alexander Minin and Senior Of Counsel Antonina Gorodetska were also among the participants of the webinar.

Senior Partner Alexander Minin and Senior Of Counsel Antonina Gorodetska were also among the participants of the webinar.

Alexander Minin dedicated his speech to the amendments regarding liability and fines under the Tax Code, which came into force on January 01, 2021.

In particular, Alexander drew attention of taxpayers to the pitfalls of new changes, and in which cases it is necessary to “keep close watch on what the tax authority is doing”. First, many changes make things even worse. At present tax legislation is confusing, and its provisions are not consistent with each other. But even this can be used for effective protection if one approaches the problem carefully and comprehensively.

The definition of “guilt” for tax purposes and burdening liability by “intentional” actions are among the key changes. In this regard, Alexander advises to be extremely careful and turn to practice of the European Court of Human Rights and the “Engel criteria”. There were also changes related to the Tax Notification Decision (TND), which came into force earlier this year, but the procedure for sending the TND has not yet been approved by the Ministry of Finance of Ukraine. Does this mean that TNDs that involve bringing to financial liability are practically impossible as such? For more interesting information on this topic please follow the link to view Alexander’s presentation.

The speech of Antonina Gorodetska was dedicated to blocking the registration of tax invoices – one of the most painful issues for taxpayers, which is still unresolved. Experience has shown that usual measures do not help – to go to court and wait for years to resolve the issue, and meanwhile the State uses excessive amounts of tax received. Or you can resort to non-standard approaches, and, as Antonina noted, “to switch the ball to the field of tax authorities”. This approach consists in adjusting the tax return, namely, reducing the VAT liability by the amount of VAT on which the invoices are blocked, and at the same time notifying the tax authority of the grounds for adjustment. The proposed option has not only “technical” significance, but also can serve as means of real taxpayers’ influence on tax policy. After all, in the case of a significant number of applications of this approach, the system will be “overloaded” and forced to look for a way out, either by changing the regulation, or at least by significant reducing the number of registrations blocked. Details on the application of this approach, what risks and consequences may arise and how to avoid them, can be found in Antonina’s presentation by the link.