2012

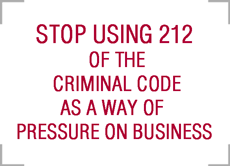

Deprive the state authorities of the opportunity to use Article 212 of the Criminal Code as a mechanism of pressure on business.

Mission of the Project:

Deprive the state authorities of the opportunity to use Article 212 of the Criminal Code as a mechanism of pressure on business.

Credo of the Project:

Why do we need to fight with tax police if it is quite enough to deprive it of means of pressure on ordinary taxpayers.

Methods:

To represent a clear picture of actual use of Article 212 of the Criminal Code by means of analysis and consideration of application practice of the respective Article; of involvement of legal community, businessmen, public organizations, to influence government (via discussion in mass media) for revealing its actual purposes: (1) to fill the budget or (2) to put pressure on business for different purposes. Refuse from clear acceptance of the fact that criminal case cannot be initiated on the basis of act of tax audit with possible fixing it in Article 212 of the Criminal Code could have been demonstration of intents to use the respective provision, first of all, as lever of pressure.

Means of goal’s achievement:

Within the current version of Article 212 of the Criminal Code to gain unified court practice which should clear indicate that criminal case cannot be initiated on the basis of act of audit.

As a best case scenario to gain fixing on a normative level that criminal case may be initiated solely in case of wilful nonpayment of agreed tax liabilities to the budget assessed in the results of tax audits carried out not under the provisions of the Criminal Procedure Code of Ukraine.

Documents on the project:

A Mistake in Tax Declaration. Article by Alexander Shemiatkin..

![]() Download pdf-file of the article (154 Kb, Ukrainian)

Download pdf-file of the article (154 Kb, Ukrainian)

![]() Cases in Russia (MS Word, 85 Kb, Russian)

Cases in Russia (MS Word, 85 Kb, Russian)

Kind regards,